Bookkeeping remains the backbone of financial stability for growing businesses. Yet, many entrepreneurs find themselves managing their books out of necessity rather than expertise. At Aiming High Solutions, we understand that proper financial management is crucial for sustainable growth.

Achieving compliance and avoiding costly penalties begins with implementing reliable accounting systems and accurate bookkeeping practices. We’ve compiled these 15 essential bookkeeping tips to help business leaders navigate financial management with confidence:

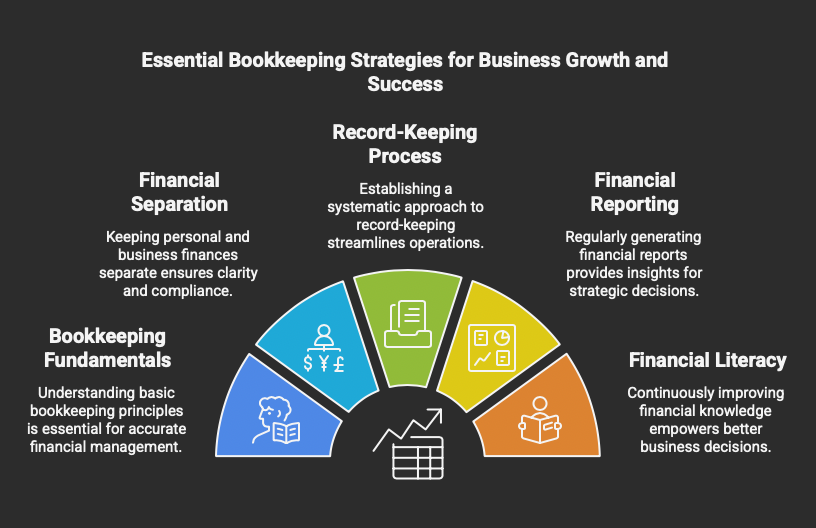

1. Master the bookkeeping fundamentals

Understanding core accounting concepts empowers you to make informed financial decisions. Familiarize yourself with essential terms like assets, liabilities, equity, revenue, and expenses. This knowledge foundation helps you interpret financial statements accurately and communicate effectively with financial professionals.

Key bookkeeping principles to understand include double-entry accounting, accrual vs. cash basis accounting, and the matching principle. Staying current with accounting best practices ensures your financial management remains both efficient and compliant with evolving regulations.

2. Separate personal and business finances

Maintaining separate business bank accounts isn’t just good practice—it’s often legally required for LLCs and corporations. The accounting community strongly advises against commingling personal and business funds, as this creates significant complications during tax season.

Dedicated business credit cards provide a clear spending trail that simplifies expense tracking. During an IRS audit, mixed personal and business transactions may result in disallowed deductions and increased scrutiny. The differences between personal and business finances extend to your financial goals, income sources, expense categories, and tax obligations.

3. Establish a systematic record-keeping process

Consistent organization forms the cornerstone of effective record-keeping. Begin by identifying which financial documents your business needs to track:

| Document Type | Examples | Retention Period |

|---|---|---|

| Income Records | Invoices, Sales receipts, Bank deposits | 7 years |

| Expense Documents | Receipts, Bills, Purchase orders | 7 years |

| Employment Records | Payroll, Benefits, Time sheets | 4+ years |

| Tax Documents | Returns, Supporting documents | 7+ years |

| Legal Documents | Contracts, Licenses, Insurance policies | Duration + 3 years |

Create logical categories for easy reference and implement a clear filing system—whether physical or digital. Schedule regular maintenance sessions (weekly or monthly) to keep records consistently organized and up-to-date.

4. Set automated reminders for key deadlines

Missing critical tax filings or payment deadlines can result in substantial penalties. Implement a robust reminder system using digital calendars with scheduled alerts for:

- Quarterly estimated tax payments

- Payroll tax deposits

- Annual tax return deadlines

- License and permit renewals

- Loan payment due dates

- Insurance premium payments

Configure notifications to provide adequate preparation time before each deadline. This proactive approach helps you maintain compliance while avoiding last-minute financial stress.

5. Build a comprehensive audit trail

A thorough audit trail provides financial transparency and simplifies any future reviews or audits. Document every transaction with corresponding supporting evidence:

- Record all purchases with vendor details and payment information

- Maintain organized digital copies of receipts and invoices

- Document the business purpose for expenses

- Keep records of all sales transactions and customer payments

- Regularly verify that your records match your bank statements

Performing monthly reconciliations helps identify discrepancies early when they’re easier to resolve, ensuring your audit trail remains accurate and complete.

6. Know your business expense categories

Tracking expenses by category reveals crucial insights about your spending patterns. Regular expense analysis helps identify:

| Expense Category | Examples | Cost-Saving Opportunities |

|---|---|---|

| Fixed Expenses | Rent, Insurance, Loan payments | Negotiate better terms, refinance loans |

| Variable Expenses | Utilities, Supplies, Shipping | Find alternative suppliers, bulk purchases |

| Periodic Expenses | Software subscriptions, Maintenance | Evaluate necessity, annual vs. monthly plans |

| Growth Investments | Marketing, Training, Equipment | Measure ROI, prioritize high-impact areas |

Understanding expense patterns enables you to make strategic decisions about resource allocation, negotiate better terms with vendors, and eliminate unnecessary costs.

7. Generate comprehensive financial reports

Regular financial reporting provides a clear picture of your business’s performance. Generate these essential reports monthly:

- Income Statement (Profit & Loss): Shows revenue, expenses, and profitability

- Balance Sheet: Outlines assets, liabilities, and equity

- Cash Flow Statement: Tracks money moving in and out of your business

- Accounts Receivable Aging: Identifies overdue customer payments

- Accounts Payable Report: Manages vendor payments efficiently

Analyzing key performance indicators within these reports—such as profit margins, debt-to-equity ratio, and inventory turnover—helps identify trends and opportunities for improvement.

8. Implement robust cash transaction tracking

Cash transactions require particularly diligent documentation to maintain accurate financial records. For every cash transaction:

- Issue numbered receipts for all cash sales

- Use a dedicated cash drawer or register

- Document petty cash disbursements with receipts

- Deposit cash regularly to minimize risk

- Reconcile cash counts daily

Regular cash reconciliation identifies discrepancies immediately, allowing for prompt investigation and resolution of any inconsistencies.

9. Budget strategically for tax obligations

Proactive tax planning prevents cash flow disruptions during tax season. Estimate your tax liability based on projected income and deductions, then:

- Set aside appropriate funds in a dedicated tax savings account

- Make timely estimated quarterly tax payments

- Track potential deductions throughout the year

- Stay informed about tax law changes affecting your industry

- Consider the tax implications of major business decisions

Consulting with a tax professional ensures you’re leveraging all available deductions while remaining fully compliant with tax regulations.

10. Invest in professional bookkeeping expertise

As your business grows, professional bookkeeping support becomes increasingly valuable. An experienced bookkeeper can:

- Ensure financial data accuracy and consistency

- Identify and correct bookkeeping errors promptly

- Prepare comprehensive financial statements

- Support business loan applications with proper documentation

- Provide financial insights to inform strategic decisions

Professional bookkeeping services free you to focus on core business operations while maintaining confidence in your financial information.

11. Conduct thorough financial statement reviews

Regular analysis of financial statements across multiple periods reveals critical business insights. Compare key metrics over time to identify:

- Revenue growth or contraction trends

- Changing profit margin patterns

- Expense category fluctuations

- Working capital management effectiveness

- Seasonal patterns affecting cash flow

These insights enable data-driven decisions about pricing strategies, cost management, inventory levels, and growth initiatives.

12. Implement comprehensive data backup systems

Protecting financial data requires a multi-layered approach to backups. Establish:

- Automated cloud storage backups with encryption

- Regular local backups to secure physical media

- Verification procedures to confirm backup integrity

- Data recovery protocols and testing

- Access controls and permission settings

This redundant approach ensures business continuity even if primary systems experience failures or security breaches.

13. Leverage cloud-based accounting software

Modern accounting platforms offer significant advantages over traditional methods. Cloud-based solutions provide:

- Real-time financial visibility from any location

- Automated transaction categorization and reconciliation

- Integrated invoicing and payment processing

- Secure document storage and retrieval

- Customizable reporting capabilities

These tools streamline bookkeeping processes while reducing the risk of manual errors.

14. Develop a month-end closing process

Implementing a structured month-end closing routine ensures consistent financial reporting. Your closing process should include:

| Step | Activities | Benefits |

|---|---|---|

| Transaction Review | Verify that all transactions are recorded | Ensures completeness |

| Reconciliation | Match bank and credit card statements | Identifies discrepancies |

| Accounts Receivable | Follow up on outstanding invoices | Improves cash flow |

| Accounts Payable | Review upcoming payment obligations | Prevents missed payments |

| Inventory Adjustment | Update inventory counts and values | Maintains accurate COGS |

| Financial Statement Generation | Create period reports | Enables timely analysis |

A formal closing checklist maintains consistency even when different team members handle the process.

15. Continuously improve financial literacy

Ongoing education about financial management strengthens your decision-making capabilities. Enhance your financial knowledge by:

- Attending industry-specific financial workshops

- Following reputable financial publications

- Participating in business financial management webinars

- Building relationships with financial mentors

- Joining peer groups to share financial management insights

As your business evolves, your financial management approach should grow in sophistication alongside it.

Transform Your Financial Management with Aiming High Solutions

By implementing these bookkeeping best practices, you establish a strong financial foundation that supports informed decision-making and sustainable growth. At Aiming High Solutions, we specialize in helping businesses optimize their financial management systems.

Our comprehensive bookkeeping services allow you to focus on strategic priorities while maintaining complete confidence in your financial data. Contact Aiming High Solutions today to discover how our expertise can elevate your business’s financial management to new heights.