As the founder of Aiming High Solutions, I’ve had countless conversations with business owners who struggle with the same challenge: managing their books effectively while trying to grow their business. Bookkeeping is the foundation of sound financial management, yet it’s often the task that gets pushed aside when more urgent matters arise.

This comprehensive guide aims to provide business owners with everything they need to know about outsourced bookkeeping services. We’ll explore what outsourced bookkeeping entails when it makes sense for your business, how to evaluate providers, implementation processes, costs, benefits, potential challenges, and how to measure success. My goal is to equip you with the knowledge to make informed decisions about your business’s financial management.

What is Outsourced Bookkeeping?

Definition and Scope

Outsourced bookkeeping services refer to the practice of hiring external professionals or firms to handle a business’s financial recording and management functions rather than performing these tasks in-house. These services can range from basic transaction recording to comprehensive financial management.

Outsourced bookkeeping services typically include:

- Recording financial transactions

- Reconciling bank and credit card accounts

- Managing accounts payable and receivable

- Processing payroll (in some cases)

- Generating financial statements and reports

- Maintaining the general ledger

- Preparing financial records for tax filing

Historical Evolution of Bookkeeping Services

Bookkeeping has evolved significantly from the days of physical ledgers and paper receipts. Understanding this evolution provides context for the current state of outsourced services:

- Traditional Bookkeeping Era (Pre-1980s): Paper-based systems with manual entries in physical ledgers

- Desktop Software Revolution (1980s-2000s): Introduction of programs like QuickBooks Desktop that digitized bookkeeping but remained locally installed

- Cloud Accounting Era (2000s-Present): Cloud-based platforms enabling remote access and real-time collaboration

- Integrated Financial Ecosystems (Current): Interconnected platforms that combine bookkeeping with banking, payment processing, and business intelligence

This evolution has made outsourced bookkeeping increasingly accessible and efficient for businesses of all sizes.

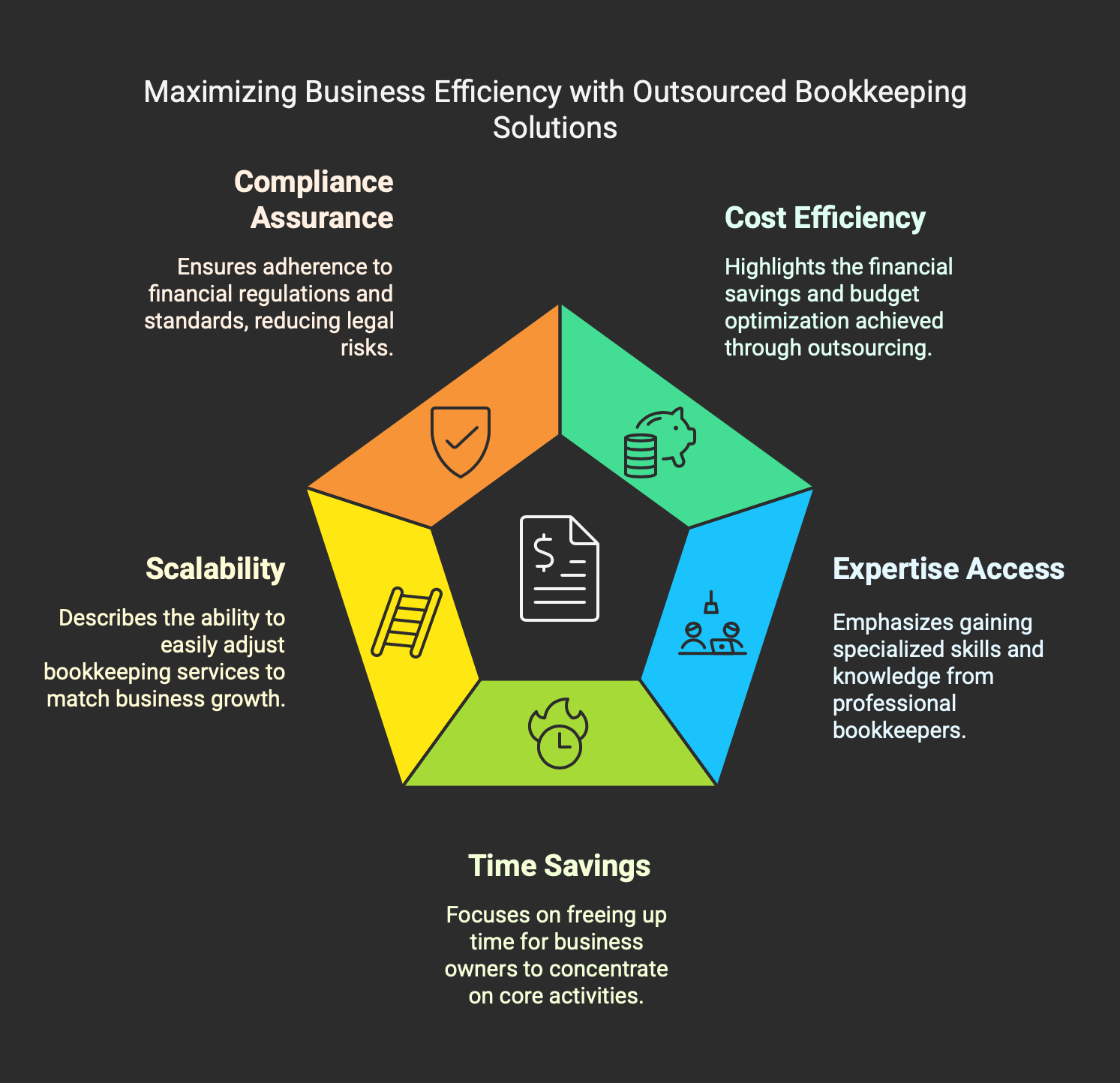

Why Businesses Consider Outsourcing Bookkeeping Services

Common Pain Points in Financial Management

Businesses typically consider outsourcing their bookkeeping when facing these challenges:

- Time Constraints: When business owners or staff spend excessive time on bookkeeping tasks

- Expertise Gaps: Lack of specialized knowledge in accounting principles or tax regulations

- Growth Transitions: Business expansion that outpaces current financial management capabilities

- Compliance Concerns: Difficulty keeping up with changing regulations and reporting requirements

- Data Quality Issues: Errors or inconsistencies in financial records affecting decision-making

- Technology Limitations: Inability to leverage advanced financial tools or integrate systems effectively

- Resource Allocation: Diverting valuable human resources from core business activities

- Scalability Challenges: Financial processes that don’t efficiently scale with business growth

Key Indicators It’s Time to Outsource

Based on my experience working with hundreds of clients, these specific signs indicate it’s time to consider outsourced bookkeeping:

- Chronically Late Books: Consistently falling behind on reconciliations or financial updates

- Tax Season Chaos: Scrambling to organize financial information before filing deadlines

- Cash Flow Surprises: Unexpected cash shortages indicating poor financial visibility

- Missed Financial Opportunities: Failing to capture tax deductions or early payment discounts

- Administrative Bottlenecks: Basic financial tasks creating workflow obstacles

- Decision Paralysis: Delaying strategic moves due to unclear financial positioning

- Compliance Penalties: Incurring fees for late filings or reporting errors

- Staff Frustration: Team members expressing dissatisfaction with financial responsibilities outside their core roles

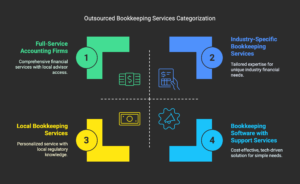

Types of Outsourced Bookkeeping Services

Local Bookkeeping Services

Local bookkeepers or bookkeeping firms operate within your geographic area and often provide both in-person and remote services.

Characteristics:

- Face-to-face meeting capabilities

- Familiarity with local business regulations

- Often available for on-site work when needed

- Potential for personal relationships and community connections

- May combine traditional and digital methods

Best suited for:

- Businesses that prefer in-person interactions

- Companies with physical documentation requirements

- Organizations with location-specific compliance needs

- Business owners who value local business relationships

Virtual Bookkeeping Services

Virtual bookkeepers provide services entirely online, leveraging technology for communication and collaboration.

Characteristics:

- Fully digital workflow

- Cloud-based document sharing and storage

- Communication via video calls, messaging apps, and email

- Often operate with extended or flexible hours

- Typically offer streamlined systems and processes

Best suited for:

- Digitally comfortable business owners

- Companies with distributed teams

- Businesses using primarily online banking and payment systems

- Organizations seeking cost-effective solutions

Full-Service Accounting Firms

Many accounting firms offer bookkeeping as part of comprehensive financial services.

Characteristics:

- Bookkeeping integrated with higher-level accounting services

- Access to CPAs and tax specialists when needed

- Often more expensive than dedicated bookkeeping services

- May include advisory services and financial planning

- Structured service tiers for different business needs

Best suited for:

- Businesses with complex financial structures

- Companies seeking both bookkeeping and advanced accounting

- Organizations planning for significant growth or transitions

- Businesses with specialized industry requirements

Industry-Specific Bookkeeping Services

Some providers specialize in particular industries with unique financial requirements.

Characteristics:

- Expertise in industry-specific accounting practices

- Familiarity with relevant regulatory requirements

- Knowledge of common financial challenges in the industry

- Often use specialized software solutions

- Understanding of industry benchmarks and metrics

Best suited for:

- Highly regulated industries (healthcare, legal, nonprofit)

- Businesses with unique inventory or cost tracking needs

- Companies with specialized billing or payment structures

- Organizations requiring industry-specific compliance reporting

Bookkeeping Software with Support Services

Some platforms offer a hybrid model combining software with professional oversight.

Characteristics:

- Self-service software platform

- Professional review and support

- Automated data entry and categorization

- Varying levels of human involvement

- Often subscription-based pricing

Best suited for:

- Tech-savvy business owners comfortable with software

- Companies with straightforward financial needs

- Organizations with consistent transaction patterns

- Businesses seeking cost-effective solutions with some professional oversight

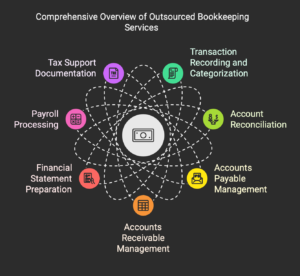

Core Functions of Outsourced Bookkeeping Services

Transaction Recording and Categorization

What it involves:

- Capturing all business transactions (sales, purchases, expenses)

- Properly categorizing transactions according to chart of accounts

- Maintaining accurate records of revenue and expenses

- Distinguishing between asset purchases and expenses

- Handling special transactions (owner contributions, loans, etc.)

Why it matters: Accurate transaction records form the foundation of all financial reporting. Proper categorization ensures that financial statements correctly reflect business activities and supports accurate tax reporting.

Account Reconciliation

What it involves:

- Comparing internal records with external statements (bank, credit card)

- Identifying and resolving discrepancies

- Ensuring all transactions are recorded and accurate

- Confirming ending balances match across systems

- Creating audit trails for reconciliation processes

Why it matters: Regular reconciliation prevents errors from compounding and provides assurance that financial reports reflect actual business performance and position.

Accounts Payable Management

What it involves:

- Processing and recording vendor bills

- Tracking payment due dates

- Managing approval workflows

- Issuing payments and recording disbursements

- Maintaining vendor records and payment history

Why it matters: Effective AP management preserves vendor relationships, captures early payment discounts, avoids late fees, and maintains accurate expense records.

Accounts Receivable Management

What it involves:

- Creating and sending customer invoices

- Tracking payment status and aging

- Following up on overdue payments

- Recording received payments

- Providing statements to customers

Why it matters: Streamlined AR processes improve cash flow, reduce bad debt exposure, and provide visibility into customer payment patterns.

Financial Statement Preparation

What it involves:

- Generating balance sheets

- Creating income statements (profit & loss)

- Producing cash flow statements

- Developing specialized reports as needed

- Ensuring compliance with accounting standards

Why it matters: Financial statements provide the critical insights needed for decision-making, tax preparation, lending applications, and business valuation.

Payroll Processing (When Included)

What it involves:

- Calculating employee wages and deductions

- Processing payroll tax withholdings

- Issuing payments to employees

- Filing required payroll tax forms

- Maintaining payroll records

Why it matters: Accurate payroll processing ensures employee satisfaction, regulatory compliance, and proper expense recognition.

Tax Support Documentation

What it involves:

- Organizing financial information for tax purposes

- Providing reports needed by tax preparers

- Ensuring transactions are properly categorized for tax reporting

- Tracking business expenses eligible for deductions

- Supporting documentation for tax filings

Why it matters: Well-organized tax documentation streamlines the filing process, maximizes legitimate deductions, and provides support in case of audit.

Technology in Outsourced Bookkeeping

Cloud Accounting Platforms

Modern outsourced bookkeeping relies heavily on cloud-based accounting software that enables real-time collaboration and data access. Common platforms include:

- QuickBooks Online: Popular for small to mid-sized businesses with extensive integration capabilities

- Xero: Known for its user-friendly interface and strong multi-currency features

- Sage Intacct: Robust solution for larger businesses with complex needs

- FreshBooks: Favored by service-based small businesses for its invoicing strengths

- Wave: Cost-effective option for very small businesses or solopreneurs

These platforms provide the foundation for efficient outsourced bookkeeping by enabling secure data sharing and collaboration.

Integration Capabilities

Effective outsourced bookkeeping systems connect with other business platforms through integrations:

- Banking Connections: Automatic transaction imports from financial institutions

- Payment Processors: Direct integration with systems like Stripe, PayPal, and Square

- Point of Sale Systems: Real-time sales data from retail operations

- E-commerce Platforms: Order and payment information from online stores

- CRM Systems: Customer data integration for invoicing and payment tracking

- Expense Management Tools: Employee expense reporting and reimbursement

- Inventory Management Systems: Cost of goods and inventory valuation

- Time Tracking Solutions: Hours tracking for service billing or payroll

These integrations reduce manual data entry, minimize errors, and create more efficient workflows.

Security Considerations

When evaluating outsourced bookkeeping technology, security is paramount:

- Data Encryption: Both in transit and at rest

- Access Controls: Role-based permissions and multi-factor authentication

- Compliance Certifications: SOC 1, SOC 2, GDPR, etc.

- Backup Procedures: Regular, automated data backups

- Disaster Recovery Plans: Protocols for data restoration

- Vendor Security Practices: Background checks and security training for staff

- Data Ownership Policies: Clear terms regarding who owns financial data

- Exit Strategies: Processes for retrieving data if changing providers

Reputable outsourced bookkeeping services will proactively address these security concerns and provide transparency about their safeguards.

Automation Capabilities

Modern bookkeeping leverages automation to improve accuracy and efficiency:

- Bank Rules: Automatic categorization of recurring transactions

- OCR Technology: Extracting data from receipts and invoices

- Payment Reminders: Automated follow-up for overdue invoices

- Recurring Transactions: Scheduled recording of regular expenses or income

- Auto-Reconciliation: Matching transactions with bank records

- Report Generation: Scheduled creation and delivery of key reports

- Workflow Automation: Approval processes and task management

These automation features reduce manual effort while improving consistency and accuracy.

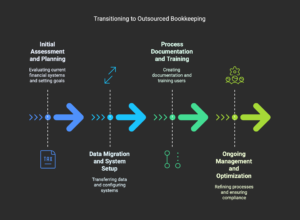

The Process of Transitioning to Outsourced Bookkeeping

Initial Assessment and Planning

The transition begins with a thorough evaluation of your current financial systems:

- Current State Analysis: Review of existing bookkeeping processes and systems

- Pain Point Identification: Documentation of specific challenges to address

- Goals and Objectives: Clear definition of what success looks like

- Scope Definition: Determining which functions to outsource

- Timeline Development: Creating a realistic schedule for implementation

- Resource Allocation: Identifying who will be involved in the transition

- Success Metrics: Establishing how results will be measured

This planning phase is critical for setting expectations and creating a roadmap for implementation.

Data Migration and System Setup

Moving to outsourced bookkeeping typically requires transferring financial data:

- Chart of Accounts Review: Evaluating and potentially restructuring your accounting categories

- Historical Data Migration: Transferring previous transactions and balances

- Beginning Balance Verification: Ensuring opening balances match previous records

- System Configuration: Setting up accounting software to match business needs

- User Access Setup: Creating appropriate permissions for team members

- Integration Configuration: Connecting with banking and other business systems

- Documentation: Recording system settings and procedures

This technical implementation phase requires attention to detail to ensure data integrity.

Process Documentation and Training

Successful transitions include clear documentation and training:

- Responsibility Matrix: Clearly defining who handles which tasks

- Workflow Documentation: Step-by-step procedures for routine processes

- Communication Protocols: Establishing how and when to exchange information

- Exception Handling: Procedures for unusual transactions or issues

- Client Training: Education on how to interact with the new system

- Timeline and Deadlines: Setting clear expectations for regular tasks

- Transition Support: Resources available during the adaptation period

This documentation provides clarity and consistency during and after the transition.

Ongoing Management and Optimization

After implementation, focus shifts to refinement and improvement:

- Regular Review Meetings: Scheduled check-ins to assess performance

- Process Refinement: Continuous improvement of workflows

- System Updates: Keeping software and integrations current

- Compliance Monitoring: Ensuring adherence to changing regulations

- Performance Metrics: Tracking key indicators of bookkeeping effectiveness

- Feedback Loops: Mechanisms for identifying and addressing issues

- Strategic Adjustments: Adapting services as business needs evolve

This ongoing management ensures the outsourced bookkeeping relationship continues to provide value over time.

Costs and ROI of Outsourced Bookkeeping Services

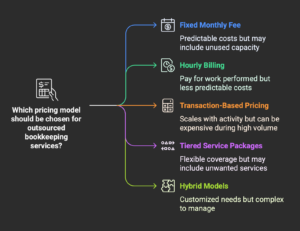

Pricing Models

Outsourced bookkeeping services typically use one of several pricing approaches:

- Fixed Monthly Fee: Set price based on business size and service scope

- Advantages: Predictable costs, easy budgeting

- Disadvantages: May pay for unused capacity in slow periods

- Hourly Billing: Charges based on actual time spent

- Advantages: Pay only for work performed, transparent billing

- Disadvantages: Less predictable costs, the potential for inefficiency

- Transaction-Based Pricing: Fees tied to volume of financial activity

- Advantages: Scales with business activity, aligns costs with usage

- Disadvantages: Can be expensive during high-volume periods

- Tiered Service Packages: Different service levels at various price points

- Advantages: Flexibility to choose appropriate coverage, room to grow

- Disadvantages: May include unwanted services in packages

- Hybrid Models: Combinations of the above approaches

- Advantages: Customized to business needs, potentially more cost-effective

- Disadvantages: Can be complex to understand and manage

Cost Comparison: In-House vs. Outsourced

When evaluating the financial impact of outsourcing, consider these cost factors:

In-House Bookkeeping Costs:

- Salary and benefits for bookkeeping staff

- Payroll taxes and insurance

- Training and professional development

- Office space and equipment

- Accounting software licenses

- Management oversight time

- Recruitment and turnover costs

- Coverage for vacation and sick time

Outsourced Bookkeeping Costs:

- Service fees (monthly, hourly, or transaction-based)

- Initial setup and transition costs

- Additional fees for special projects or services

- Technology integration expenses

- Internal time for oversight and communication

Most businesses find that outsourcing is more cost-effective than maintaining equivalent in-house capabilities, particularly when accounting for all hidden costs of employment.

Calculating Return on Investment

To determine the ROI of outsourced bookkeeping, assess these factors:

- Direct Cost Savings:

- Reduction in personnel expenses

- Elimination of software and equipment costs

- Lower training and development expenses

- Efficiency Gains:

- Time redirected to revenue-generating activities

- Faster financial processes and reporting

- Reduced errors and rework

- Strategic Benefits:

- Better financial insights for decision-making

- Improved cash flow management

- Enhanced compliance and risk reduction

- More scalable financial operations

- Opportunity Costs:

- Value of business owner’s time redirected from bookkeeping

- Growth opportunities captured through better financial management

- Competitive advantages from more strategic financial focus

A comprehensive ROI calculation should consider both quantitative savings and qualitative benefits.

Hidden Costs and Benefits

When evaluating outsourced bookkeeping, be aware of these often-overlooked factors:

Potential Hidden Costs:

- Communication overhead during transition

- Potential learning curve and adaptation period

- Time spent reviewing and providing feedback

- Possible cultural or operational misalignments

- Technology integration challenges

Often Overlooked Benefits:

- Access to financial expertise beyond bookkeeping

- Reduced stress and mental burden for owners

- Business continuity during staff transitions or absences

- Exposure to best practices from other industries

- Scalability without recruitment or training delays

- Objective financial perspective from outside the business

A thorough evaluation includes these less obvious but meaningful factors.

Quality Control in Outsourced Bookkeeping

Establishing Clear Standards

Effective outsourced bookkeeping relationships begin with clearly defined expectations:

- Service Level Agreements (SLAs): Documented standards for timeliness, accuracy, and responsiveness

- Quality Metrics: Specific measurements for evaluating performance

- Error Thresholds: Acceptable margins of error for different processes

- Documentation Standards: Requirements for record-keeping and notes

- Compliance Requirements: Specific regulatory or tax-related standards

- Reporting Expectations: Format, frequency, and content of financial reports

- Communication Protocols: Standards for regular updates and issue reporting

These established standards create accountability and provide a framework for evaluation.

Monitoring and Performance Review

Ongoing quality assurance requires regular monitoring:

- Periodic Reviews: Scheduled evaluations of bookkeeping accuracy and timeliness

- Spot Checks: Random sampling of transactions for verification

- Reconciliation Verification: Independent confirmation of account reconciliations

- Key Performance Indicators (KPIs): Tracking metrics like days to close books or error rates

- Client Feedback Systems: Structured processes for gathering and addressing input

- External Validations: Occasional reviews by third-party accountants or auditors

- Continuous Improvement Tracking: Monitoring progress against identified issues

These monitoring processes help identify and address issues before they become significant problems.

Common Quality Issues and Prevention Strategies

Anticipating potential problems allows for proactive management:

- Data Entry Errors

- Prevention: Automated data capture, double-entry verification, regular reconciliation

- Miscommunication About Transactions

- Prevention: Clear documentation procedures, regular check-ins, shared transaction notes

- Missed Deadlines

- Prevention: Shared calendars, advance reminders, clear responsibility assignments

- Inconsistent Categorization

- Prevention: Detailed chart of accounts, transaction classification guidelines, periodic reviews

- Security Breaches

- Prevention: Strong access controls, security training, regular audits, encrypted communications

- Knowledge Gaps About Business

- Prevention: Comprehensive onboarding, industry education, business model documentation

- Software Integration Problems

- Prevention: Thorough testing, documented procedures, technical support relationships

Addressing these common issues proactively ensures higher quality service over time.

Continuous Improvement Frameworks

Effective outsourced bookkeeping partnerships evolve through structured improvement:

- Regular Service Reviews: Scheduled evaluations of overall performance

- Issue Tracking Systems: Documentation of problems and resolution status

- Root Cause Analysis: Investigating underlying causes rather than symptoms

- Feedback Loops: Mechanisms for incorporating client and team input

- Process Documentation Updates: Regular revision of procedures based on learnings

- Technology Optimization: Ongoing refinement of system configurations

- Professional Development: Continued education for bookkeeping team members

This commitment to improvement ensures the relationship remains valuable as business needs evolve.

Industry-Specific Considerations

Retail and E-commerce

Businesses selling physical products have unique bookkeeping requirements:

- Inventory Management: Tracking cost of goods sold and inventory valuation

- Sales Tax Complexities: Multi-jurisdiction compliance for physical and online sales

- High Transaction Volumes: Efficient processing of numerous daily sales

- Seasonal Fluctuations: Managing cash flow during variable business cycles

- Multiple Sales Channels: Integrating data from physical stores, online platforms, and marketplaces

- Return Processing: Accurately recording refunds and exchanges

- Vendor Management: Tracking numerous supplier relationships and payments

Outsourced bookkeepers for retail businesses should demonstrate specific expertise in these areas.

Professional Services

Service-based businesses face different challenges:

- Time-Based Billing: Tracking billable hours and rates

- Project Accounting: Managing costs and revenues by client or project

- Retainer Management: Tracking prepaid services and usage

- Milestone Billing: Invoicing based on project completion stages

- Subconsultant Expenses: Managing payments to external contributors

- Work in Progress Tracking: Accounting for partially completed services

- Resource Allocation: Connecting staff utilization to financial performance

Professional service firms benefit from bookkeepers with experience in their specific service model.

Construction and Contracting

The construction industry has specialized bookkeeping needs:

- Job Costing: Tracking expenses by project or job site

- Progress Billing: Invoicing based on completion percentages

- Retention Accounting: Managing held-back payment portions

- Subcontractor Management: Tracking payments and compliance documentation

- Equipment Costing: Allocating equipment expenses to projects

- Change Order Tracking: Recording approved modifications to contracts

- Compliance Documentation: Maintaining required certifications and filings

Construction bookkeeping requires industry-specific knowledge and systems.

Nonprofits and Associations

Tax-exempt organizations have unique requirements:

- Fund Accounting: Tracking restricted and unrestricted funds separately

- Grant Management: Recording grant revenues and associated expenses

- Donor Reporting: Providing required documentation to supporters

- Program Expense Allocation: Attributing costs to specific initiatives

- Form 990 Preparation: Organizing information for tax filings

- Board Reporting: Creating governance-focused financial updates

- Compliance Documentation: Maintaining records for exempt status

Nonprofit bookkeeping combines standard practices with specialized requirements.

Healthcare Practices

Medical businesses face particular challenges:

- Insurance Billing Reconciliation: Tracking expected vs. actual reimbursements

- Patient Payment Processing: Managing copays and direct patient billing

- HIPAA Compliance: Ensuring financial records meet privacy requirements

- Provider Compensation Tracking: Allocating revenues by physician or provider

- Multiple Location Management: Consolidating finances across practice sites

- Specialized Coding Requirements: Using industry-specific transaction codes

- Third-Party Payer Relationships: Managing complex payment arrangements

Healthcare bookkeeping requires an understanding of both medical and financial systems.

Common Challenges and Solutions

Communication Barriers

Challenge: Geographic separation and differing work schedules can impede clear communication.

Solutions:

- Establish regular video conference check-ins

- Use collaborative tools with comment capabilities

- Create clear escalation procedures for urgent issues

- Document communication preferences and expectations

- Implement shared calendars for deadlines and availability

- Schedule quarterly strategy meetings for bigger-picture discussions

- Consider time zone differences when planning communication

Security and Privacy Concerns

Challenge: Sharing financial data creates potential security vulnerabilities.

Solutions:

- Implement secure document-sharing platforms

- Use role-based access controls for financial systems

- Require encryption for data transmission and storage

- Create clear data handling and retention policies

- Regularly review and update security protocols

- Establish breach notification procedures

- Conduct periodic security assessments

- Consider SOC-compliant service providers

Business Knowledge Gaps

Challenge: External bookkeepers may lack understanding of industry or business specifics.

Solutions:

- Create detailed documentation of business operations

- Provide industry context and terminology explanations

- Schedule dedicated onboarding sessions

- Share strategic plans and business objectives

- Establish processes for handling unusual transactions

- Provide feedback on industry-specific reporting needs

- Consider specialized bookkeepers with relevant experience

Change Management

Challenge: Transitioning from in-house to outsourced bookkeeping requires adaptation.

Solutions:

- Create a phased implementation plan

- Identify and address staff concerns proactively

- Clearly communicate the rationale for change

- Provide training on new systems and processes

- Celebrate early wins and improvements

- Establish realistic timeline expectations

- Maintain some continuity during transition

- Consider a hybrid approach initially

Scalability and Growth Transitions

Challenge: Business growth may outpace initial bookkeeping arrangements.

Solutions:

- Build scalability provisions into service agreements

- Regularly review service needs against business projections

- Establish triggers for service level adjustments

- Document processes to facilitate knowledge transfer

- Create contingency plans for rapid growth scenarios

- Consider modular service structures that can expand

- Maintain clear performance metrics to evaluate capacity

The Future of Outsourced Bookkeeping

Technological Trends

The bookkeeping landscape continues to evolve with these emerging technologies:

- Artificial Intelligence and Machine Learning

- Automated transaction categorization with increasing accuracy

- Anomaly detection for potential errors or fraud

- Predictive analytics for cash flow forecasting

- Natural language processing for financial queries

- Blockchain Applications

- Immutable transaction records for enhanced audit trails

- Smart contracts for automated payment processing

- Transparent shared ledgers for improved verification

- Enhanced security for financial data

- Advanced Data Analytics

- Real-time financial dashboards and visualizations

- Benchmarking against industry performance metrics

- Pattern recognition for business intelligence

- Scenario modeling for strategic planning

- Enhanced Mobile Capabilities

- Receipt capturing and processing on mobile devices

- Approval workflows from anywhere

- Real-time financial updates on smartphones

- Mobile-first interfaces for financial data access

These technologies will continue to make outsourced bookkeeping more efficient and valuable.

Evolving Service Models

The structure of outsourced bookkeeping services is changing:

- Integrated Financial Services

- Bookkeeping combined with CFO services and strategic advisory

- Bundled tax preparation and compliance support

- Holistic financial management approaches

- Technology implementation and optimization services

- Specialized Vertical Solutions

- Industry-specific bookkeeping packages

- Compliance-focused offerings for regulated sectors

- Technology-aligned services for specific platforms

- Growth-stage targeted solutions (startup, scale-up, mature)

- Global Service Delivery

- Follow-the-sun service models for constant coverage

- Multi-language support for international operations

- Cross-border compliance expertise

- Cultural sensitivity in financial practices

- Value-Based Pricing

- Outcome-focused fee structures

- Performance-linked pricing models

- Business impact measurement

- Strategic partnership approaches

These evolving models emphasize value creation beyond transaction processing.

Emerging Compliance Considerations

The regulatory landscape continues to affect bookkeeping practices:

- International Financial Reporting Standards (IFRS) Convergence

- Increasing global standardization of accounting rules

- Changes to recognition and disclosure requirements

- Impact on comparative financial reporting

- Data Privacy Regulations

- Expanding requirements like GDPR and CCPA

- Customer financial information protection

- Cross-border data transfer restrictions

- Consent and disclosure obligations

- Digital Taxation Initiatives

- Evolving sales tax requirements for remote sellers

- International digital service taxes

- Automated compliance reporting requirements

- Real-time tax data transmission mandates

- Environmental, Social, and Governance (ESG) Reporting

- Financial tracking of sustainability initiatives

- Carbon accounting and climate risk disclosure

- Social impact measurement and reporting

- Governance structure documentation

Staying ahead of these compliance trends will be critical for effective bookkeeping.

Skills Development for Future Bookkeeping

As the profession evolves, bookkeepers are developing new competencies:

- Technology Expertise

- Cloud platform mastery

- Data integration knowledge

- Automation implementation skills

- Cybersecurity awareness

- Advisory Capabilities

- Financial analysis and interpretation

- Business process optimization

- Strategic planning support

- Performance metric development

- Data Management

- Database structure understanding

- Data cleansing techniques

- Information architecture principles

- Business intelligence concepts

- Communication Skills

- Financial information translation for non-experts

- Remote collaboration effectiveness

- Visual presentation of financial data

- Cross-functional team participation

These evolving skill sets reflect the transformation of bookkeeping from transaction processing to strategic support.

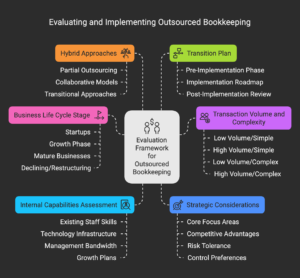

Making the Decision: Is Outsourced Bookkeeping Right for Your Business?

Assessment Framework

Consider these factors when evaluating if outsourced bookkeeping is appropriate:

- Business Life Cycle Stage

- Startups: Often benefit from immediate expertise without full-time cost

- Growth Phase: May need scalable solutions as complexity increases

- Mature Businesses: Might consider outsourcing for efficiency and focus

- Declining/Restructuring: Could use outsourcing to reduce fixed costs

- Transaction Volume and Complexity

- Low Volume/Simple: May be manageable in-house with basic solutions

- High Volume/Simple: Good candidate for outsourced efficiency

- Low Volume/Complex: May benefit from specialized expertise

- High Volume/Complex: Often requires professional management

- Internal Capabilities Assessment

- Existing Staff Skills: Current team’s financial expertise

- Technology Infrastructure: Systems already in place

- Management Bandwidth: Time available for financial oversight

- Growth Plans: Anticipated changes in financial needs

- Strategic Considerations

- Core Focus Areas: What activities directly drive business success

- Competitive Advantages: Where the business should invest time

- Risk Tolerance: Comfort level with financial management risks

- Control Preferences: Desired level of direct oversight

This framework helps determine if outsourcing aligns with your business needs.

Hybrid Approaches

Many businesses benefit from combined models:

- Partial Outsourcing

- Keeping strategic financial functions in-house

- Outsourcing transaction processing and reconciliation

- Maintaining financial oversight internally

- Using external expertise for specialized tasks

- Collaborative Models

- Internal bookkeeper with outsourced oversight

- External bookkeeping with internal financial analysis

- Shared responsibilities with clear delineation

- Technology-enabled collaboration between internal and external teams

- Transitional Approaches

- Starting with comprehensive outsourcing

- Gradually building internal capabilities

- Periodic reassessment of the optimal balance

- Flexibility to adjust as business needs evolve

These hybrid approaches offer customized solutions that can evolve with your business.

Creating a Transition Plan

If you decide to pursue outsourced bookkeeping, a structured transition helps ensure success:

- Pre-Implementation Phase

- Establish clear objectives and success criteria

- Document current processes and pain points

- Select the appropriate service provider or model

- Set realistic timelines and milestones

- Identify key stakeholders and responsibilities

- Implementation Roadmap

- Define the data migration approach

- Establish a parallel processing period if necessary

- Create a training plan for affected staff

- Develop communication strategy

- Build contingency plans for unexpected issues

- Post-Implementation Review

- Measure results against established objectives

- Gather feedback from all stakeholders

- Identify opportunities for optimization

- Document lessons learned

- Create an ongoing management framework

A thoughtful transition plan increases the likelihood of positive outcomes.

Conclusion: The Strategic View of Outsourced Bookkeeping

Outsourced bookkeeping represents more than just a tactical decision about who handles financial transactions—it’s a strategic choice about how to allocate business resources and focus. When implemented thoughtfully, it can transform financial operations from a necessary administrative function to a source of strategic insight and competitive advantage.

As the founder of Aiming High Solutions, I’ve witnessed this transformation across businesses of all sizes. The most successful implementations share common characteristics: clear objectives, thoughtful provider selection, well-managed transitions, and ongoing oversight with continuous improvement.

Whether you choose to outsource your bookkeeping fully, partially, or maintain it in-house, the key is alignment with your business goals and operations. Financial management should support your strategic objectives rather than diverting resources from them.

I encourage you to approach this decision deliberately, considering both immediate needs and long-term aspirations. With the right approach, your financial function can become a catalyst for growth rather than a constraint.

About the Author

Adam Smith is the CEO and founder of Aiming High Solutions, a specialized outsourced bookkeeping service provider helping businesses transform their financial operations. With extensive experience working with companies across multiple industries, Adam brings a unique perspective on the challenges and opportunities in financial management for growing businesses.